Introduction

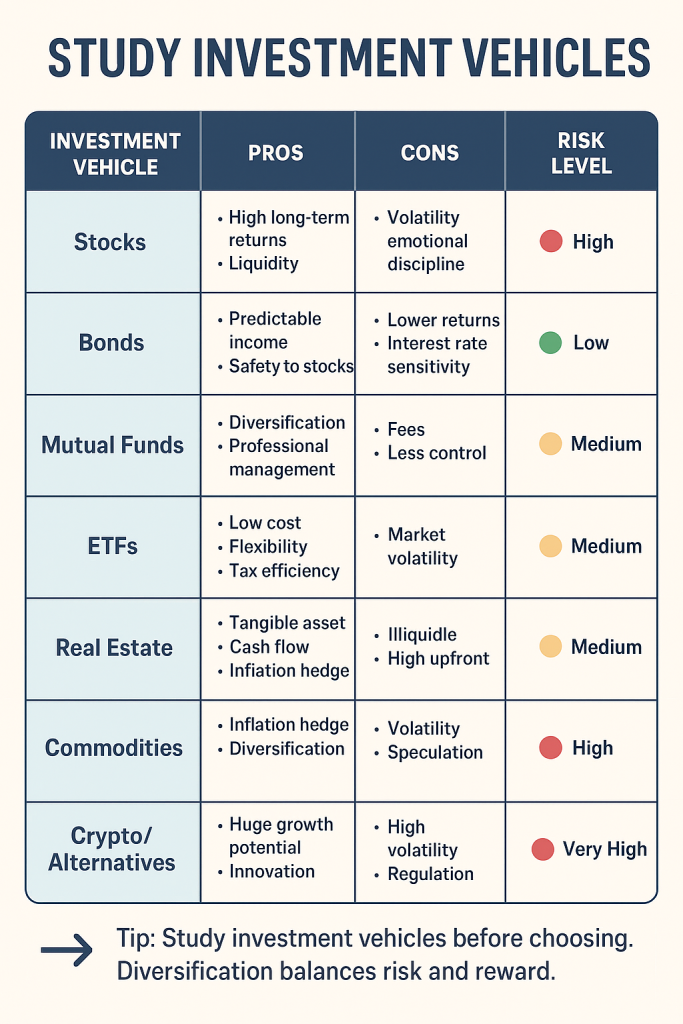

When you study investment vehicles, you unlock the roadmap to financial growth and long-term wealth creation. Too often, people dive into investing without understanding the very tools at their disposal. Investment vehicles—stocks, bonds, mutual funds, real estate, ETFs, and more—are not just abstract concepts. They’re structured ways to put your money to work.

In the first 100 words here, let’s set the stage: study investment vehicles carefully, and you’ll see how each works differently to balance risk and return. Whether you’re just starting out or fine-tuning your portfolio, understanding these vehicles is critical. This ultimate guide covers the basics, advanced strategies, academic studies, and real-world examples of how people use investment vehicles to secure financial freedom.

Table of Contents

- What Are Investment Vehicles?

- Why You Should Study Investment Vehicles Before Investing

- Categories of Investment Vehicles: A Big-Picture View

- Stocks: Ownership and Growth Potential

- Bonds: Stability and Fixed Income

- Mutual Funds: Diversification Made Simple

- Exchange-Traded Funds (ETFs): Flexibility and Low Cost

- Real Estate: Tangible Asset and Cash Flow Generator

- Commodities: Gold, Oil, and the Inflation Hedge

- Alternative Investments: Crypto, Private Equity, and More

- Retirement Accounts as Investment Vehicles

- Tax Implications of Different Vehicles

- Risk and Return: Balancing Your Portfolio

- Academic Studies on Investment Vehicle Performance

- Behavioral Psychology and Investment Choices

- Case Studies of Investment Vehicle Success

- How to Study Investment Vehicles Like a Pro

- Common Mistakes Beginners Make

- Building a Long-Term Strategy With Multiple Vehicles

- Conclusion: Redefining Your Investment Journey

1. What Are Investment Vehicles?

Investment vehicles are simply the structures or instruments through which you invest your money. They serve as “vehicles” because they move your capital from idle cash into growth opportunities. Some vehicles are simple (like a savings bond), while others are complex (like hedge funds).

Think of them like transportation: just as you might choose a car, bus, or plane depending on your destination, you choose an investment vehicle based on your financial goals, risk tolerance, and time horizon.

2. Why You Should Study Investment Vehicles Before Investing

A 2022 FINRA study revealed that 66% of retail investors misunderstand basic features of common investment products. This lack of knowledge often leads to poor returns and unnecessary risk.

By studying investment vehicles, you gain:

- 📈 Confidence in decision-making

- 💰 Clarity on costs, fees, and risks

- 🛡️ Protection against scams or bad advice

- 🎯 Alignment between goals and strategies

Skipping this step is like driving a car without learning the road rules.

3. Categories of Investment Vehicles: A Big-Picture View

Broadly, investment vehicles fall into:

- Equity-based: Stocks, mutual funds, ETFs

- Debt-based: Bonds, treasury securities, corporate loans

- Tangible assets: Real estate, commodities

- Alternative vehicles: Hedge funds, crypto, private equity

Each has unique characteristics. The art of investing is knowing how to combine them.

4. Stocks: Ownership and Growth Potential

Stocks are perhaps the most recognized investment vehicle. Buying stock means owning part of a company.

Pros:

- Historically high long-term returns (~10% annually for the S&P 500).

- Liquidity—can be bought/sold quickly.

- Dividend income potential.

Cons:

- Volatile in the short term.

- Requires research and emotional resilience.

📊 Study reference: A 2019 Morningstar study confirmed that equities consistently outperform bonds and cash over long horizons, but with higher volatility.

5. Bonds: Stability and Fixed Income

Bonds are essentially loans you give to governments or corporations in exchange for interest payments.

Pros:

- Lower volatility than stocks.

- Predictable income stream.

- Useful for diversification.

Cons:

- Lower returns compared to equities.

- Sensitive to interest rate changes.

Fun fact: According to the U.S. Treasury, 10-year Treasury bonds historically yield between 2–5%. Safe, but not high growth.

6. Mutual Funds: Diversification Made Simple

Mutual funds pool money from multiple investors to buy a portfolio of stocks, bonds, or both.

Why they matter:

- Professional management.

- Easy diversification.

- Accessible for beginners.

Study: Research from Vanguard shows that diversified mutual funds significantly reduce risk compared to holding individual stocks.

7. Exchange-Traded Funds (ETFs): Flexibility and Low Cost

ETFs combine the best of mutual funds and stocks. They track an index but trade like shares.

Advantages:

- Lower fees than mutual funds.

- Highly liquid.

- Ideal for passive investing.

ETFs have exploded in popularity: according to Statista, global ETF assets surpassed $10 trillion in 2023.

8. Real Estate: Tangible Asset and Cash Flow Generator

Real estate investment can be residential, commercial, or REITs (Real Estate Investment Trusts).

Pros:

- Appreciation + rental income.

- Tangible security.

- Inflation hedge.

Cons:

- Requires large capital.

- Illiquid compared to stocks.

- Maintenance costs.

Case: During the 2008 housing crisis, poorly managed real estate leverage wiped out investors—showing that studying this vehicle carefully is crucial.

9. Commodities: Gold, Oil, and the Inflation Hedge

Commodities offer diversification and protection against inflation.

- Gold: Safe haven in crises.

- Oil: Sensitive to geopolitical events.

- Agricultural goods: Prone to climate impact.

Studies (World Bank, 2021) show commodities often move inversely to equities, making them strong diversifiers.

10. Alternative Investments: Crypto, Private Equity, and More

Alternative vehicles are high-risk, high-reward. Examples:

- Crypto: volatile but disruptive.

- Private equity: long-term, high entry barriers.

- Hedge funds: exclusive, complex strategies.

A Yale study found endowments with alternative assets significantly outperform traditional 60/40 stock-bond portfolios.

11. Retirement Accounts as Investment Vehicles

401(k)s, IRAs, and pensions are vehicles with tax advantages. They don’t invest directly but hold other vehicles inside them.

- Traditional IRA → Tax-deferred growth.

- Roth IRA → Tax-free withdrawals.

The power here is compounding with tax benefits.

12. Tax Implications of Different Vehicles

Each vehicle comes with tax consequences:

- Stocks: capital gains tax.

- Bonds: taxed as ordinary income.

- Real estate: depreciation deductions.

- Retirement accounts: tax deferral.

Smart investors study these details before choosing.

13. Risk and Return: Balancing Your Portfolio

The risk-return tradeoff is the golden rule. Higher risk often equals higher potential return.

📊 Modern Portfolio Theory (Markowitz, 1952) proved that diversification across vehicles reduces risk without sacrificing much return.

14. Academic Studies on Investment Vehicle Performance

- Fama & French (1992): Value and small-cap stocks outperform over time.

- NBER (2018): ETFs democratize access but may increase market volatility.

- Harvard Business Review (2020): Private equity funds yield higher returns but require long horizons.

15. Behavioral Psychology and Investment Choices

Studies show investors often choose vehicles emotionally:

- Chasing “hot” stocks.

- Over-trusting real estate.

- Ignoring diversification.

Behavioral finance (Kahneman & Tversky) highlights how biases distort choices.

16. Case Studies of Investment Vehicle Success

- Warren Buffett: Built Berkshire Hathaway by focusing on stocks and insurance vehicles.

- Ray Dalio: Diversified into alternative vehicles like hedge funds.

- Everyday Investors: Those who stuck with ETFs through market downturns often outperform active traders.

17. How to Study Investment Vehicles Like a Pro

- Read reliable sources (Morningstar, Investopedia).

- Compare historical returns vs. risks.

- Study expense ratios and fees.

- Simulate portfolios using tools like Portfolio Visualizer.

18. Common Mistakes Beginners Make

- Investing without studying vehicles.

- Over-concentration in one type (e.g., only real estate).

- Ignoring fees.

- Short-term trading mentality.

19. Building a Long-Term Strategy With Multiple Vehicles

A balanced portfolio might include:

- 60% stocks (ETFs for broad exposure).

- 20% bonds (stability).

- 10% real estate.

- 10% alternatives (crypto, commodities).

This mix diversifies risk while maximizing growth.

20. Conclusion: Redefining Your Investment Journey

When you study investment vehicles, you stop guessing and start investing with strategy. Each vehicle has strengths, weaknesses, and ideal uses. The smartest investors combine them to build resilient, diversified portfolios.

The lesson? Don’t just invest—study first. The more you understand vehicles, the better they’ll carry you toward wealth and financial freedom.

Explore more insights on Business & Financial Psychology at Koaladash

See the Morningstar Research on Investment Performance here.