Lifestyle Creep: How to Recognize It, Stop It, and Take Back Control of Your Money

Have you ever noticed that the more you earn, the more you seem to spend—yet your savings don’t grow as much as you expected? That sneaky financial phenomenon has a name: lifestyle creep. It happens when increased income leads to increased spending on non-essential items like dining out, subscriptions, gadgets, or luxury upgrades. At first, it feels like rewarding yourself for working hard, but over time, lifestyle creep can silently erode wealth and keep you stuck in a paycheck-to-paycheck cycle. In this post, we’ll unpack the psychology, real-world studies, and actionable strategies to prevent lifestyle creep from sabotaging your financial future.

Table of Contents

- What is Lifestyle Creep?

- The Psychology Behind Lifestyle Creep

- Signs You’re Experiencing Lifestyle Creep

- Why Lifestyle Creep is Dangerous for Your Finances

- Lifestyle Creep vs. Lifestyle Inflation

- Studies & Research on Spending Habits

- The Role of Social Pressure & Comparison

- Real-Life Examples of Lifestyle Creep

- How to Prevent Lifestyle Creep Before It Starts

- Strategies to Reverse Lifestyle Creep

- Building Habits That Resist Lifestyle Creep

- Financial Tools & Systems That Help

- Long-Term Benefits of Controlling Lifestyle Creep

- Final Thoughts

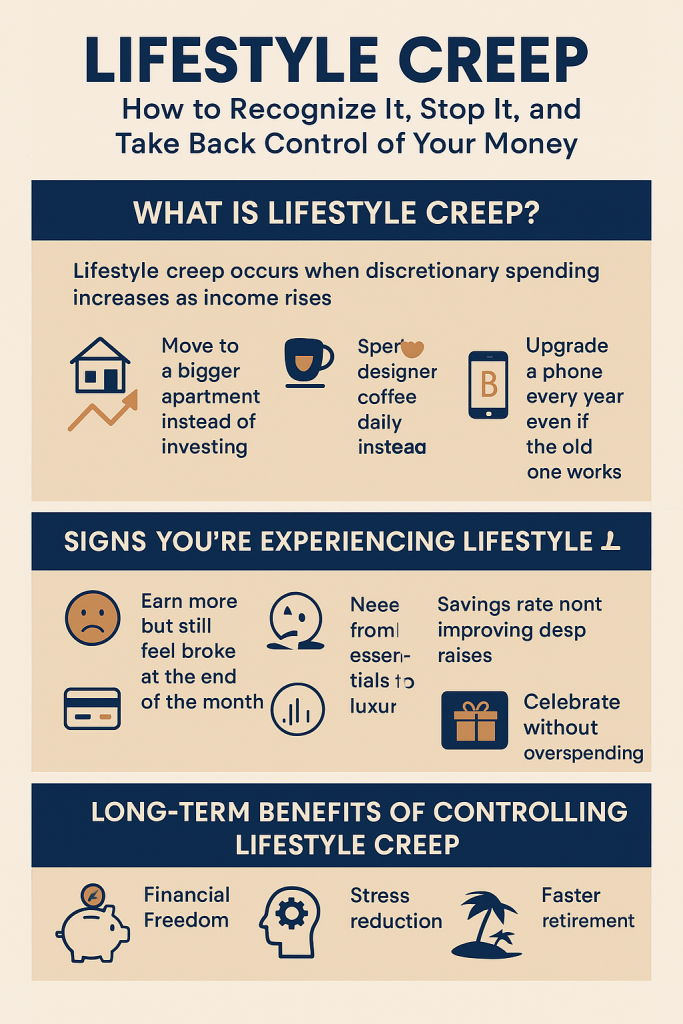

1. What is Lifestyle Creep?

Lifestyle creep occurs when discretionary spending increases as income rises. Instead of allocating that extra money toward savings, investments, or debt repayment, it gets funneled into conveniences, luxuries, and upgrades.

For example:

- After a promotion, you move to a bigger apartment instead of investing.

- You start buying designer coffee daily instead of brewing at home.

- You upgrade your phone every year even if the old one works perfectly.

This isn’t about occasional indulgences. The danger lies in consistent, unconscious spending patterns that reset your financial “baseline” higher and higher.

2. The Psychology Behind Lifestyle Creep

Lifestyle creep isn’t just about money—it’s about human psychology. Several cognitive biases drive it:

- Hedonic Adaptation: Humans quickly adapt to new comforts. That luxury car feels exciting for a few months, then becomes the “new normal.”

- Reward Bias: “I worked hard, I deserve this” justifies spending.

- Anchoring Effect: Once we start buying at a higher level, it becomes the benchmark.

A 2016 Journal of Consumer Research study highlighted that increased income rarely correlates with long-term happiness because people adapt to higher consumption quickly.

3. Signs You’re Experiencing Lifestyle Creep

How do you know if lifestyle creep is creeping into your finances? Watch for these signs:

- You earn more now but still feel broke at the end of the month.

- Your “needs” have shifted from essentials to luxuries.

- Your savings rate hasn’t improved despite raises.

- You rely on credit cards to maintain your lifestyle.

If these sound familiar, lifestyle creep may be eroding your financial growth.

4. Why Lifestyle Creep is Dangerous for Your Finances

Lifestyle creep doesn’t just shrink savings—it compounds into long-term financial stress.

- Delayed Wealth Building: Money that could grow in investments is spent on depreciating assets.

- Debt Accumulation: Keeping up appearances often means borrowing.

- Financial Fragility: If income drops (job loss, recession), high fixed costs leave you vulnerable.

A Bankrate survey (2022) found that 56% of Americans couldn’t cover a $1,000 emergency expense, despite many reporting higher incomes than five years earlier.

5. Lifestyle Creep vs. Lifestyle Inflation

Though often used interchangeably, there’s a subtle difference:

- Lifestyle creep is unconscious spending—money slipping away without intention.

- Lifestyle inflation is a deliberate choice to upgrade your life as income rises (e.g., choosing a safer neighborhood, better healthcare, or experiences that align with values).

The key is awareness and intentionality.

6. Studies & Research on Spending Habits

Several studies show the link between income, spending, and happiness:

- Princeton University (2010): Happiness rises with income only up to about $75,000/year. Beyond that, spending more doesn’t equal higher life satisfaction.

- University of Michigan (2018): People tend to anchor happiness to relative wealth, not absolute income. If friends spend more, individuals follow suit.

- Harvard Business Review (2020): Experiences provide more lasting happiness than material upgrades, reducing lifestyle creep.

7. The Role of Social Pressure & Comparison

One major driver of lifestyle creep is social comparison.

- Social media showcases curated luxury lifestyles, creating pressure to “keep up.”

- Workplace culture often encourages expensive lunch outings, fancy clothes, or vacations.

- Peer pressure can normalize overspending.

A study by The American Economic Review found that neighborhoods with higher-income families increased spending pressure on lower-income households, often pushing them into debt.

8. Real-Life Examples of Lifestyle Creep

- John, the Engineer: Salary doubled in 5 years, but his expenses rose alongside—new car, apartment, gadgets. Savings remained flat.

- Maria, the Nurse: After overtime pay, she subscribed to multiple streaming platforms, ordered takeout daily, and took luxury vacations. She ended up with credit card debt.

- Corporate Executives: Many high-income earners face the same trap—lavish lifestyles but low net worth.

9. How to Prevent Lifestyle Creep Before It Starts

Practical strategies:

- Automate Savings: Direct raises into retirement or investment accounts.

- Set Lifestyle Boundaries: Decide your “enough” lifestyle and stick to it.

- Adopt a 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt repayment.

- Celebrate Without Overspending: Reward yourself with experiences, not material excess.

10. Strategies to Reverse Lifestyle Creep

If lifestyle creep has already set in, here’s how to reverse it:

- Track Expenses: Awareness is the first step. Use budgeting apps.

- Cut Recurring Costs: Cancel unused subscriptions, renegotiate bills.

- Downsize Where Possible: Smaller apartment, older car—reclaim cash flow.

- Create Financial Goals: Link spending decisions to long-term dreams (house, business, early retirement).

11. Building Habits That Resist Lifestyle Creep

- Practice Gratitude: Research shows gratitude reduces the urge to overspend.

- Minimalist Mindset: Focus on value, not volume.

- Delay Gratification: Impose a 30-day waiting period on big purchases.

- Surround Yourself Wisely: Spend time with people who value financial discipline.

12. Financial Tools & Systems That Help

Tools that help combat lifestyle creep:

- Budgeting apps: YNAB, Mint, PocketGuard.

- Automatic transfers: Redirect raises into investments.

- Envelope system: Allocate cash for discretionary spending.

- Net worth tracker: Seeing progress motivates saving over spending.

13. Long-Term Benefits of Controlling Lifestyle Creep

By controlling lifestyle creep, you unlock:

- Financial Freedom: More savings, more investment opportunities.

- Stress Reduction: Lower financial anxiety.

- Resilience: Ability to weather emergencies.

- Faster Retirement: A higher savings rate compounds wealth over time.

A Vanguard study (2021) showed that households who kept expenses steady while income grew reached retirement 7–10 years earlier than peers who inflated lifestyles.

14. Final Thoughts

Lifestyle creep is subtle but powerful. It disguises itself as well-deserved rewards for hard work but can trap even high earners in financial stagnation. By understanding its psychology, recognizing the warning signs, and implementing intentional strategies, you can resist the trap and build lasting wealth.

Remember: every raise, bonus, or side hustle income is an opportunity—not for lifestyle creep, but for lifestyle freedom.

💡 Call to Action:

Want to stop lifestyle creep in its tracks? Start today by tracking your last 30 days of expenses and ask yourself: Did this purchase bring me long-term value—or just temporary comfort?

For more on managing your money with intention and building wealth through mindful spending, check out Frugality and Personal Finance: Your Blueprint for Wealth — it’s a great companion piece to understanding lifestyle creep and how to prevent it.

also check out https://www.frugalfamily.co.uk/